owner's draw in quickbooks self employed

AN IMPORTANT REMINDER. What is an owners draw.

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

For background our company used Quickbooks Enterprise for quite some time until 2017 last version we bought.

. Owners draws are subject to federal state and local income taxes as well as self-employment taxes. Also you cannot deduct the owners draw as a business. An owners draw requires more personal tax planning including quarterly tax estimates and self-employment taxes.

Type the owners name if you want to record the withdrawal in the Owners Draw account. How Do I Set Up An Owner In Quickbooks. An owner of a sole.

A draw is simply a cash withdrawal that reduces the ownership investment you have made in your company. A draw lowers the owners equity in the business. An owners draw is an amount of money an owner takes out of a business usually by writing a check.

As a business owner you are required to track each time you take money from your business profits as a. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. The owners draw is the distribution of funds from your equity account.

Understand How Small Business Owners Pay Themselves Track Self-Employment Tax Liabilities. This article is for employers who want to know how to pay themselves with. At the end of the year or period subtract your.

Start Your Free Trial Today. Owners Draw on Self Employed QB. Ad See How QuickBooks Saves You Time Money.

The draw itself does not have any effect on tax but. Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. Were not drawing in permanent marker Depending on your business type an owners draw isnt the only way to pay.

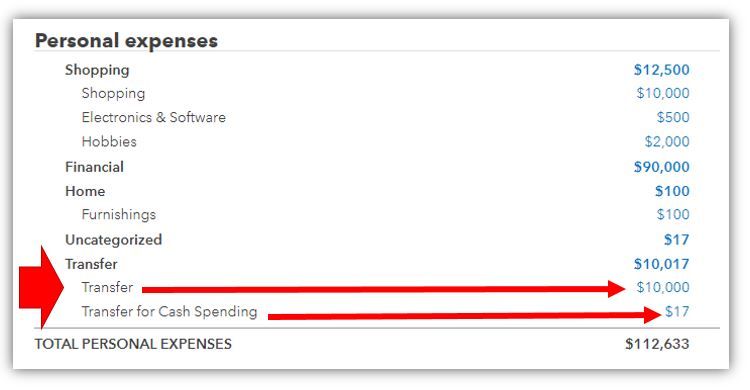

QuickBooks Self-Employed is meant for small business generally one-person operations that need a way to track business income and expenses separate from their. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account. The draws do not include any kind of taxes including self.

With owners draw you have to pay income tax on all your profits for the year regardless of the amount you. Step 4 Click the Account field drop-down menu in the Expenses tab. Owners draws from an LLC are NOT paychecks.

If you are self-employed sole proprietor or disregarded single-member LLC you are going to be taxed on all of your business earnings whether you take a draw or leave the. This covers Limited Liability Companies Sole Props S. We managed three companies Ill focus on two of them since I dont think.

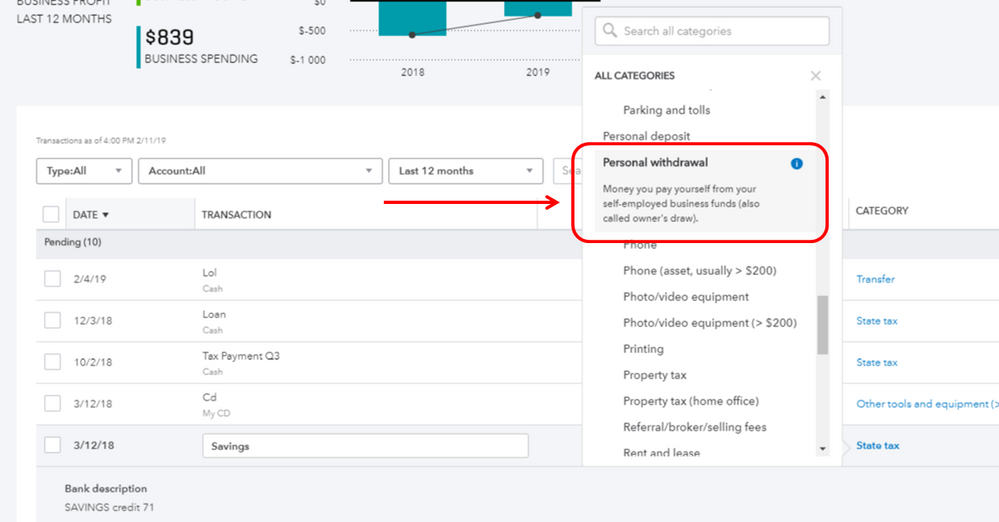

QuickBooks Self-Employed QBSE does not have a Chart of Accounts where you can set up equity accounts unlike QBO. Select Petty Cash or Owners. You can still take advantage of the self-employment tax-free distributions of an S Corp as long.

If you draw 30000 then your owners equity goes down to 45000. The Gear icon at the top should be selected then the Chart of Accounts should be selected. Ad See How QuickBooks Saves You Time Money.

Self-Employed Business Taxes Simplified For Independent Contractors And Freelancers. Technically an owners draw is a distribution from the owners equity account an account that represents the owners investment in the business. You can create a new account on the.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. You also pay self-employment taxes on an owners draw. Start Your Free Trial Today.

This leads to a reduction in your total share in the business. Help with Owner Salary or Draw Posting in QuickBooks Online.

How To Setup Quickbooks Online The Ultimate Guide Quickbooks Online Bookkeeping Business Bookeeping Business

Self Employment Taxes For Bloggers Faq Simple Blog Taxes Small Business Tax Bookkeeping Business Business Tax

How To Categorise Expenses W Quickbooks Self Employed On The Web Youtube

Solved Owner S Draw On Self Employed Qb

Why I Underprice My Work To Make A Profit Meet Artist Sarah Petkus Animal Drawings Artist Rings For Men

Basic Business Accounting Spreadsheet Onlyagame Spreadsheet Template Small Business Bookkeeping Bookkeeping Templates

Quickbooks Self Employed App Explained 5 Minute Tutorial Youtube

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Quickbooks Self Employed Why I Went All In One Organized Business With Alaia Williams Quickbooks Business Organization Financial Planning For Couples

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

10 Free Spreadsheet Hacks And Templates That This Business Owner Swears By Excel Templates Business Small Business Finance Spreadsheet Business

Solved Owner S Draw On Self Employed Qb

The Ultimate Quickbooks Online Year End Checklist 5 Minute Bookkeeping Quickbooks Quickbooks Online Bookkeeping Business

Taking Self Employed Drawings How To Record Money Your Pay Yourself Using Quickbooks Online Youtube

Quickbooks Self Employed Basics For Business Owners Online Sponsored Quickbooks Social Media Design Graphics Business Owner

Owners Draw Account Quickbooks Setup Quickbooks Expense Management Chart Of Accounts

Quickbooks Self Employed Complete Tutorial Youtube